1031 Exchanges Explained

Tax season is a time of year that most Americans dread, but it’s also a great reminder to check that you’re making the most of your tax benefits. When it comes to large transactions such as buying or selling a ranch, every percentage point counts. Are you familiar with a 1031 exchange? If not, keep reading to find out how you can defer taxes on the sale of your existing property and reinvest more of your money into a new property.

Keep More of Your Tax Dollars

As defined by the Internal Revenue Code, a 1031 exchange states: “No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment purposes if such property is exchanged solely for property of a like-kind which is to be held for either productive use in trade or business or for investment purposes.”

Simply put, a 1031 exchange is a way to defer capital gains taxes on the sale of real property used for business or investment, by re-investing the funds in a like-kind property. Often used in farm and ranch transactions for the tax saving benefits, the 1031 exchange is a wealth building tool – enabling farmers and ranchers to invest the tax savings dollars into their new operation and grow their investment holdings. The government regulations were initiated to encourage sellers to invest back in their community, in hopes of continued economic growth.

During an exchange transaction, the funds from the relinquished property sale are never received by the seller. Instead, they are managed by a qualified intermediary (QI) to directly purchase the replacement property. Qualifying for a 1031 exchange is as simple as being a US taxpayer, whether as an individual or a company. Both the relinquished and replacement property in the transaction must be used for business or investment purposes. Personal property, such as primary residences, do not qualify. The replacement property must be equal or greater to the gains realized from the sale of the relinquished property, but the properties do not have to be the same type. Examples of types of property that can be exchanged according to Accruit, a 1031 Exchange QI, are:

- Commercial properties

- Multi-family rentals

- Vacant lots

- Single-family rentals

- Vacation rentals (Airbnb / VRBO)

- Farmland and ranches

- Improvements on property not already owned

- Oil, gas, and other mineral interests

- Water rights

- Cell tower, billboard, and fiber optic cable easements

- Conservation easements

- Delaware Statutory Trusts (DST’s)

What You Need to Know

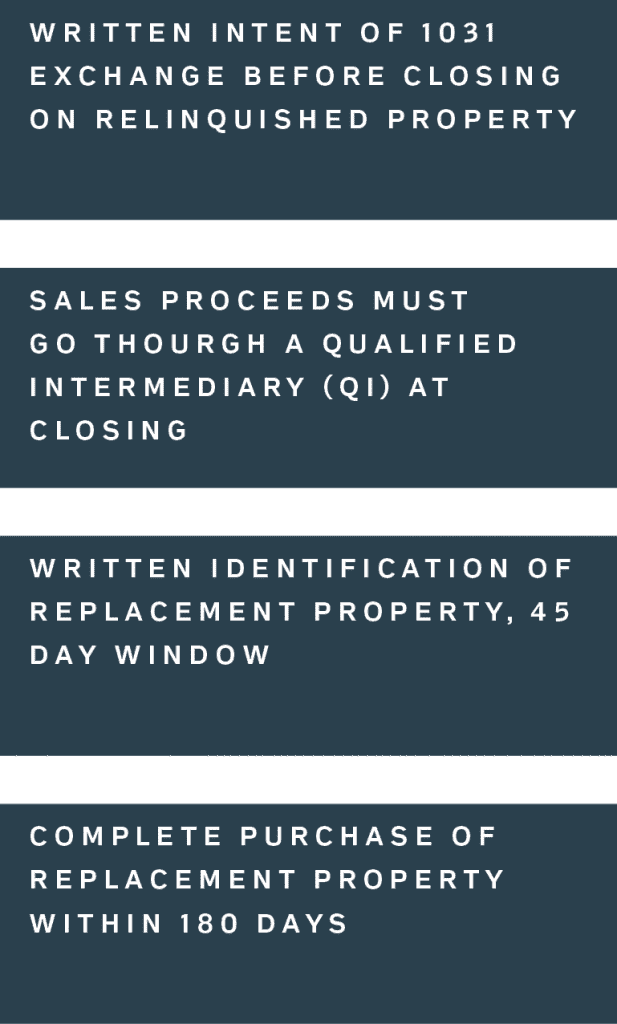

A successful 1031 exchange process begins with contacting a qualified QI before the initial sale of the property. A property sale followed by a purchase does not qualify for the tax benefits provided by the 1031 exchange, and sellers must comply with the procedures as listed in the tax code. A reverse exchange can be completed after the sale of the relinquished property and before the purchase of a replacement property, but a QI must be part of the transaction to qualify it as a verified exchange. The typical 1031 exchange transaction process is as follows:

A few things to keep in mind if you are considering a 1031 exchange:

- The purchase price of the new property must be equal or greater to the sale price of the initial property.

- All of the equity from the sale of the relinquished property must be re-invested in the new property (no debt relief).

- The same taxpayer must be the seller and buyer in the exchange requirement (the code refers to tax identity, not necessarily the name on the property’s title).

- The 1031 exchange can not be initiated after the close of a sale, if a taxpayer has access to the funds the exchange tax rules no longer apply.

- Farmland and ranches are considered qualified for a 1031 exchange. Vacant land/lots, conservation easements and vacation homes can also be exchanged.

- Farms and ranches that may have a primary residence, crops, water/mineral rights, should consult their QI to see if those assets can be included in the exchange.

- Properties operating as vacation rentals or investment opportunities as part of a 1031 exchange can be converted to personal property after two years.

- There are time limits to a 1031 exchange: the replacement property must be identified within 45 days of the transfer of the relinquished property and the seller has 180 days from the date of the transfer to close on the replacement property.

The 1031 like-kind exchange is an integral part of ranch, farm and land transactions – utilized nationwide by sellers and buyers to acquire and trade real property assets. We have years of experience in these tax saving transactions and can walk you through the process. We work closely with a Qualified Intermediary who we consider to be the best in the business. Contact us to learn more about a 1031 exchange and how it might benefit you. Caleb Campbell

Is a 1031 Exchange Right for You?

The tax benefits of a 1031 exchange are very attractive, but it’s important to consider the challenges of this type of transaction. Property sales are happening in record numbers and in record time in the current real estate market. The 180 day property sale window seems more than enough, but finding a replacement property within the 45 days may prove to be more difficult. Making property improvements before the exchange deadlines could also prove trying with many manufacturing and transportation delays due to the pandemic.

Working with a Qualified Intermediary (QI), and a real estate broker who you can trust, will help you decide if the 1031 Exchange is right for you and ensure that your transaction goes smoothly. Western Ranch Brokers has extensive experience in these types of transactions, especially as it relates to farm and ranch real estate. Contact us to find out more about a 1031 exchange and see how we can go to work for you.